Suppose that the Sample Company has three issues of convertible preferred shares outstanding. Each has a par value of $10,000,000 and is convertible to 200,000 shares of common stock. Whereas common stock is often called voting equity, preferred stocks usually have no voting rights. The company is not allowed to pay common shareholder any dividends until it pays preferred shareholders all outstanding and current dividends. The potential for higher dividends can make participating preferred stock an attractive investment option for those seeking upside potential.

What are preferred dividends?

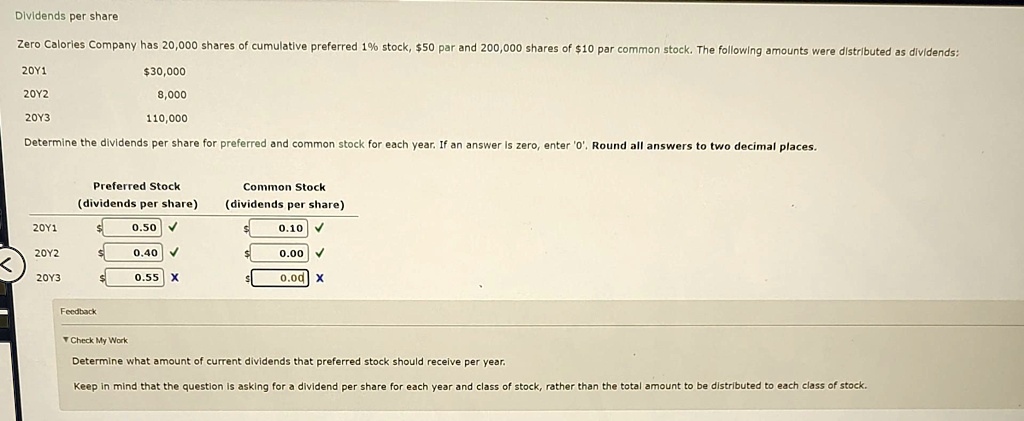

These standard preferred shares are sometimes referred to as non-cumulative preferred stock. Cumulative preferred stockholders have the right to receive these missed dividends in arrears, ensuring they are paid before common shareholders. In contrast, noncumulative preferred stock does not accumulate dividends in arrears, meaning any missed payments are forgone and cannot be claimed in the future. This is because preferred dividends take precedence over common dividends, ensuring preferred shareholders are paid first.

What are the types of preferred dividends?

- The priority of preferred dividends ensures that cumulative obligations are satisfied before any common stock dividends are paid, safeguarding the interests of preferred shareholders.

- On the other hand, if conversion is assumed, the dividends would not have been paid and, accordingly, are not deducted from net income.

- Arrearages in payment of cumulative dividends may be related to the firm’s financial condition, or they may result from dividend-payment decisions made by management.

- If a company does not pay a dividend on cumulative preferred stock for a particular year, that is known as “dividend in arrears.” It will be disclosed in a note on the company’s balance sheet.

Moreover companies carefully weigh the advantages and disadvantages of dividend policies when determining their steps. On the other hand, if conversion is assumed, the dividends would not have been paid and, accordingly, are not deducted from net income. Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Please read the SEBI prescribed Combined Risk Disclosure Document prior to investing. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Cumulative Dividends 101: A Beginner’s Guide to Compounding Payouts

If the company does not declare and pay a dividend to preferred shareholders, it cannot pay a dividend to common shareholders. What happens to the preferred shareholders’ payments if the company misses a payment depends on whether their dividends are cumulative or non-cumulative. 7% preferred stock refers to a type of preferred share that pays a fixed annual dividend equal to 7% of its par value, providing investors with a consistent and predictable income stream. Additionally, suspending preferred dividends may lead to a negative impact on the company’s reputation and stock price, as shareholders may lose confidence in the company’s financial health. Companies may offer a choice between cash or stock dividends to preferred shareholders, allowing them to choose the option that best aligns with their financial goals and investment strategies.

How Do Cumulative Dividends Work?

If the company does not call the stock in, shares may continue to trade past their call date. Yes, preferred stockholders can lose dividends if a company suspends or reduces dividend payments. This can occur with both cumulative and non-cumulative preferred stock, signaling potential financial difficulties and impacting shareholder confidence. In contrast, common dividends are often subject to the company’s earnings performance and board of directors’ discretion, making them less predictable than preferred dividends. In contrast, stock preferred dividends are paid in the form of additional shares of the company’s stock. The tax implications of stock dividends depend on whether the shares are held or sold.

How can you invest in preferred shares for dividends?

Stock dividends, on the other hand, increase the number of shares held by preferred shareholders, potentially leading to long-term capital appreciation if the company’s stock price rises. The distinction between cumulative and non-cumulative dividends highlights the varying degrees of protection and priority accorded to preferred shareholders. In the case of non-cumulative preferred stocks, this feature of arrear payment is not available. If a bond issuer defaults on an interest payment, bondholders can sue the company, take it over and sell off its parts for cash. If a corporation is liquidated, bondholders are paid ahead of preferred shareholders. Next, divide the annual dividend by four to calculate the preferred stock’s quarterly dividend payment.

Whenever the company earns a profit, it must clear the past accumulated dividends first, and then common shareholders can be paid. To calculate cumulative dividends per share, you must add the missed dividends to the current dividend from the preferred stock dividends formula. For example, suppose you own 1,000 shares of Company X cumulative preferred stock. The major selling point for preferred stock is its high dividend yield, usually in the 4 percent to 8 percent range.

Individual and institutional investors can both benefit from the steady income that they can be paid. However, institutions may receive a highly attractive tax advantage in the dividends received deduction tax filing options 2021 on that income that individuals do not. This arrangement increases the possibility of a higher payoff and generally allows the stated preferred dividend rate to be set lower than otherwise.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Committed to helping readers at every life stage achieve their financial goals, BG Vance provides tailored guidance to empower others on their journey to financial independence and early retirement.